The Partners for Growth category and business experts look at ways retailers can help both their customers and their business viability, in the face of this challenging trading environment.

The Partners for Growth team of experts met to discuss the impact that the steep increase in the cost of living is having on convenience retailers. With energy, fuel and food prices all rising at unprecedented levels, driving inflation to a 40-year high, the Retailer Advisory Panel universally agreed that this presented one of the biggest challenges of recent times for retailers.

Retailer Advisory Panel member Ramesh Shingadia comments: “We, as retailers, know that many of our customers are really struggling to make ends meet, so we need to try to keep prices as low as possible to be competitive. However, with the rise in energy costs and price rises resulting in margin pressures, retailers will face challenges in doing this, so they will need to look for other ways to adapt their store offering to help achieve this.”

Here, we share insights about the changes in shopper behaviour and the Retailer Advisory Panel’s recommendations to help retailers adapt their businesses to meet both the changing shopper priorities and the impact of rapidly rising overheads.

What impact has the rise in the cost-of-living had?

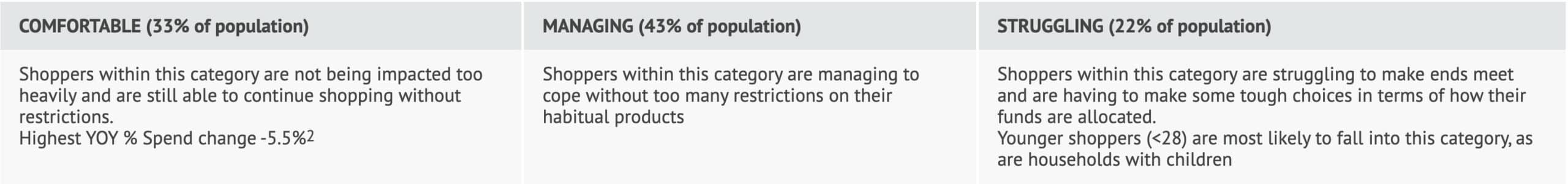

Early evidence suggests that shoppers are already using coping strategies to deal with price increases in terms of what products they choose, how they consume and where they shop, butnot all shoppers are being affected in the same way. Research has identified three distinct groups of shoppers, some 22% of whom are now struggling to make ends meet1 – an increase of 6% since November 2021.

Unsurprisingly, Struggling Shoppers are spending less per trip and less per pack and are relying more on discounters and freezer centres, while the Comfortable Shoppers – a group seeing an 8% decrease since November 2021 – are relying on supermarkets and online for their shopping. However, the convenience channel, with the second-highest penetration and frequency of purchase across all formats, is very well placed to meet everyone’s needs.

Unilever shopper mission research brings new understanding of shopper behaviour

In 2021, Unilever undertook extensive shopper mission research, interviewing in excess of 17,000 shoppers. It found that shopper missions had evolved by adopting a category mindset understanding, which provided a more complete view of shopping behaviour. It found that shoppers switched mindsets as they shopped different categories, so by understanding a shopper’s mindset, convenience retailers could tailor their product offering and in-store communication to grow sales.

Unilever category director Kat Simpson comments: “While most shoppers across all retailer formats do some level of research or referencing before buying, our study found that convenience shoppers were less likely to look at price and promotional information prior to a purchase. For these shoppers, proximity is the key driver as they are on a ‘Needs for Today’ mission and mindset. These shoppers have a higher experiential mindset than those on a supermarket trip and are more likely to make their decision at the point

Simpson adds: “Convenience stores are also perfectly placed to help the Struggling group of shoppers who are most exposed to the cost-of-living crisis, as fuel costs for their shopping trip are also brought into consideration when deciding upon a retailer to complete their shopping mission.”

Retailer Advisory Panel recommendations for Retailers

According to the Partners for Growth Retailer Advisory Panel, retailers should now urgently be reviewing their businesses to better cater for shoppers’ changing priorities and need states in the face of the rise in the cost of living. They should also be looking closely at their business fundamentals and reviewing all costs and prices to ensure their business is well placed to navigate the challenging times ahead.

Panel mem

—————————————————-

Five Point Action Plan

1. Review your range

Making sure your offering meets your shoppers’ needs has always been key for a convenience store, but with shopper priorities and need states shifting, it’s now more important than ever. Keeping an eye on business fundamentals will inform retailers how the cost-of-living crisis is affecting their stores. Understanding how many shoppers visit the store, how much they are spending, and what they are currently buying – i.e. more value-oriented products or products on promotion – will help you identify and de-list slower sellers to provide an optimised range to meet customers’ new priorities.

2. Ensure your store communicates value

With energy and fuel costs due to peak this autumn, retailers should ensure that their stores clearly communicate value, which will help retain shoppers. This could include:

- Increasing the range of price-marked packs, which help to give reassurance to ‘struggling’ shoppers that they are getting value in the store.

- Stocking more value-oriented product lines – including an own-label range to give price-sensitive shoppers a greater number of alternatives.

- Offering a loyalty scheme, to give loyal customers the benefit of getting even greater value, and at the same time secure more sales.

3. Play to your convenience strengths

The primary reason shoppers come to your store is to satisfy a mission. By tapping into the experiential mindset of convenience shoppers, retailers can make their store a destination for their community and use this to generate incremental impulse purchases. Having created space by optimising their range, retailers can look to introduce new products and services, such as slush machines, vape stations, delicatessen, bakery or butchery services, which all deliver significantly higher margins, to help ease the pressure at a time when overheads are increasing and margins are being squeezed.

Panel member Mandeep Singh, of Singh’s Premier comments: “We recently introduced a Refreshment Station, which offers twice the margin of traditional soft drinks, and has attracted a huge number of shoppers looking for a simple, low-cost family treat, at a time when they can’t afford to go out for a bigger treat. It has been one of our most popular categories and, during hot weather, we’ve had shoppers literally queuing outside the store.”

4. Maintain your margins

With inflation running at a 40-year high, and current typical energy quotes showing a five-fold increase on prior years, it is important for retailers to keep an eye on their business fundamentals and increase their prices to ensure they fully cover their increasing overheads and price rises, so that they maintain their store’s operating margin. If this isn’t feasible, then they should look to identify higher-margin products or services, which will help them maintain their overall margin.

Spar retailer David Charman comments: “Most convenience retailers won’t have experienced inflation at these levels before, and this new inflationary climate necessitates a different mindset to running a retail business than over the last 30 years. It is key to review your business fundamentals and prices regularly to get a clear understanding of how the cost-of-living crisis is affecting your business. It is essential to pass on price increases to customers in order to maintain your margins. Failure to do so really could put your business in jeopardy.”

5. Ensure good availability on key lines

The panel highlighted the importance of good availability, which is something they have all had challenges with recently. Their solution was to focus on the best-sellers, approach different wholesalers, visit cash & carries more frequently, and search out different suppliers, all of which helped them keep stocked up with the best-selling lines.

Source

1 Kantar – Worldpanel LinkQ Survey, April 2022

2 Kantar – Worldpanel Total FMCG w/e Apr 22

34 Responses

k3q671

tlgyle

7qp41z

vg670m

57gigf

43o5lk

dfoqvg

x1bezw

q5hl23

z4ui8v

w8xhsa

fw83l6

9zh4c4

g5jflm

7mmjle

u4uxj1

qw3p74

m3z5gj

tuna4g

odudnu

vp85f7

249r4t

y68l40

34l19t

gu9ma3

yuavsa

2faw41

f52f81

dog3np

ts5jj0

ks6m06

7itexy

zaqrdg

s615g6